War by Other Means? Geoeconomics in the 21st Century

Economics and politics entertain a complex, sometimes wrought, relationship which has captivated analysts and political philosophers throughout the ages.

Research Office, Geneva Graduate Institute.VIDEO: A critical analysis of the weaponisation of economics, by Beatrice Weder di Mauro

Looking back at the last three centuries, the history of international economic relations seems to have been a constant back-and-forth between these two seemingly irreconcilable paradigms. While the realist (or mercantilist) approach prevailed for most of world history, the liberal idea that trade is a constituent element of peace and international cooperation has gained traction since the late eighteenth century. Drawing on the notion of “doux commerce”, Montesquieu famously argued in De l’esprit des lois (1748) that “the natural effect of commerce is to lead to peace”. Kant similarly contended in Perpetual Peace (1795) that republics had no intrinsic interest in going to war with each other and that, with the help of providence, a world-wide federation of peaceful nations would eventually rule out the use of force at the international level. Two decades later, finally, Benjamin Constant, despite writing in the context of the Napoleonic Wars, was confident that “[w]e have finally reached the age of commerce, an age which must necessarily replace that of war”.[1] The liberal model gained the upper hand in the second halves of the nineteenth and twentieth century when “benevolent” hegemons, either the British Empire or the United States, would govern the world to uphold the principles of free trade and free access to natural resources for capital-oriented extractive multinational companies, whose functions were to best serve the interests of their own shareholders and provide commodities for the cheapest price on global markets.

The victory of the liberal camp seemed secure until recently, when politics or “geoeconomics” – the association between geopolitics and economics – came back to haunt the liberal consciousness. The current Dossier aims to identify the key drivers in these transformations and the future direction of the international economic system. It contains contributions on the issues of economic nationalism, sanctions, predatory regulations, illicit finance, debt, and the neocolonial scramble for resources, and explores their repercussions on global commercial and financial policies and governance.

The Economic Face of the Spirit of Geneva in the Long Twentieth Century

Geneva has long been a global hub where these two visions of the international economic order were debated, contested, and reinvented. Many interwar liberal apologists of the “spirit of Geneva” believed that greater economic interconnectedness and international arbitration would not only mitigate conflicts and spread democracy worldwide, but also force old empires and new nation-states to integrate into some form of higher union, or federal compact, whose organs were to be situated in Geneva with the League of Nations (Mazower 2013). At the same time, Geneva-based financial experts at the League of Nations designed new tools of economic warfare to sanction countries that violated the territorial integrity of League members – such as Italy, which was sanctioned for its war against Ethiopia in 1935–1936 – and to deter others from doing so (Mulder 2021).

Economic blockades and financial sanctions were part of the register of actions proposed by Geneva-based experts in the interwar period, although, as Quinn Slobodian (2018) has demonstrated in his history of the Geneva Graduate Institute, the liberal school in Geneva, which included thinkers who held academic positions at the Institute such as William Rappard, Michael Heilperin, Ludwig von Mises and Wilhelm Ropke, often dominated over the realists, even during the Cold War.

During the Cold War and the age of decolonisation, indeed, the Geneva-based version of “neoliberalism”, or “Washington Consensus”, meant that Geneva experts were often wary of the influence that politics could play in the instrumentalisation of the economy. Such adherence to the neoliberal model of “good governance” (as experts called it from the mid-1980s onward) may have explained the long distrust in which postwar Geneva economic experts held economic sanctions, even those designed and implemented by international organisations – although others opposed the first decisions adopted by the United Nations Security Council (UNSC) to sanction a country like South Africa during Apartheid, because their vision of the international economic order was still profoundly shaped by a colonial worldview and they had no objection to the maintenance of racist rule (Slobodian 2018).

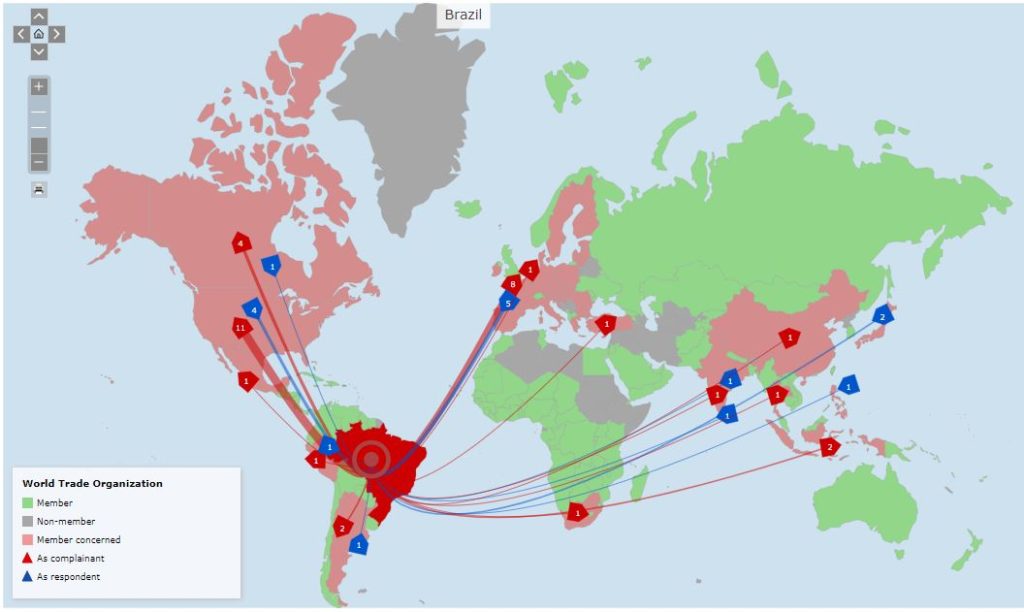

In the post–Cold War period, the transformation of the organisation in charge of monitoring the General Agreement on Tariffs and Trade (GATT) into the permanent World Trade Organization (WTO), endowed with a court-like procedure to adjudicate trade disputes on the shores of Lake Geneva, again placed Geneva on the map of worldwide hot spots of economic globalisation and liberal rulemaking.

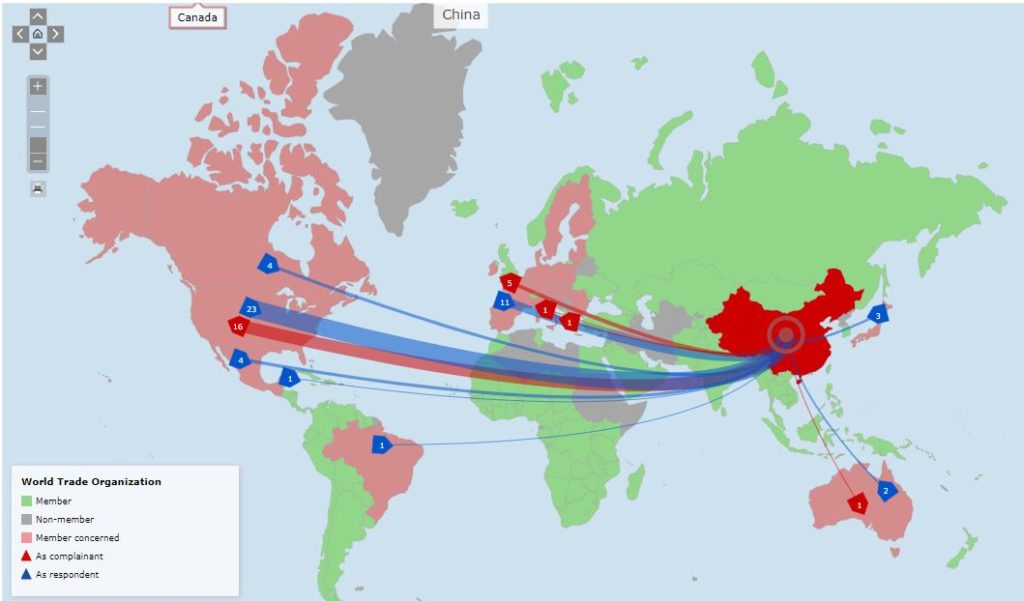

The Rise of the US-China Rivalry and the crisis of liberal multilateralism

Among the root causes of the current crisis in the international liberal economic order that many commentators consider of the utmost importance are the economic and financial rise of China and the US reaction to it. After the Second World War, the United States had set up with its allies a set of multilateral institutions such as the International Monetary Fund (IMF), the World Bank (WB) and the GATT, in order to lay the foundation of a liberal global economic order based on free trade, economic integration and the controlled global circulation of capital so as to encourage greater trade openness without the risk of exposing states to rapid changes in the worldwide distribution of capital flows. At first concentrated on the North Atlantic, it took on truly global dimensions in the 1990s and early 2000s with the collapse of the Soviet Union and the great unbundling (or offshoring) of production. The transformation of “global value chains” and their increasing localisation in China culminated in China’s adhesion to the WTO in 2001. Originally, the system was tilted against countries like China, but some hoped it could integrate outsiders and turn them into compliant observers of the global rules it was meant to promote.

The end of the Cold War indeed allowed certain optimists – like Francis Fukuyama – to believe that the integration of China within the powerhouses of the liberal international economic order would reinforce both that global ordering effort and those “reformist” actions coming from within the Chinese political system. For Chinese reformist leaders, the new social contract between the state and Chinese consumers meant that, as their citizens acceded to a much higher level of personal wealth thanks to their integration in global markets, they would not challenge too forcefully the basics of the Chinese political system. The “end of history” argument assumed that that all people of the world would tame their revolutionary ambitions at the national and transnational level – contesting the unlimited exploitation of the soil by extractive industries, struggling to distribute profits more equally between labour and capital, etc. – because they would accept to give priority to consumer welfare as the post–Cold War globalisation kept prices low thanks to the “natural” search of capital for the most economic forms of production. However, this prophesy failed to materialise.

Indeed, the emergence of a more multipolar world in the early 21st century, led by China and its peculiar brand of state-capitalism, witnessed the decline of liberalism and multilateralism. Various factors, some independent of Chinese actions but others related, have ushered in a new era of regained tension and mercantilism in international economic relations since the 2000s. For many commentators, the US and China play a key role in this “weaponization of the economy” (Pomeroy 2022). First, the global financial crisis that followed the realisation of the vulnerability of the US housing market dealt a significant blow to the international economic system: in particular, it challenged international financial institutions (IFIs) like the IMF and the World Bank, whose role in the rescue of defaulting global banks and states was minimal. As Adam Tooze described, the 2008 financial crisis was dealt with in a quasi-unilateral manner by the US financial regulators, which acted as lender of last resort for all global banks with wide exposure to the collapsing US financial market; similarly, the European Central Bank also became a provider of liquidity for global banks in pressing need of euros (Tooze 2018). Financial governance was rearticulated outside the purview of the IMF, on a strong unilateral and bilateral basis, thus hurting the credibility of multilateralism. And when the IMF was included in the “troika” that managed post-2008 sovereign debt crises, like in the Greek episode, it further lost popularity among the populations to which it administered its neoliberal treatment. Thus, whereas the US had been able to closely monitor key international economic institutions such as the IMF and the World Bank during the Bretton Woods era, it increasingly resorted to unilateral tactics, leading critics to accuse the US of financial and regulatory imperialism, hijacking international regulations or devising predatory norms reminiscent of the extraterritorial regimes of the past, as in the case of the 2010 Foreign Account Tax Compliance Act (FATCA).

To add insult to injury, during the last decade the WTO also lost its central role as an agenda-setting agency for multilateral trade agreements and as an arbiter of trade disputes, with many powers now reverting to regional or bilateral trade agreements or even unilateral trade measures (a euphemism for sanctions). The debate over whether the world had reached “peak globalisation”, along with lingering scenarios of “slowbalisation” or “deglobalisation”, thus started to emerge in the field of trade (Baldwin 2022). In parallel, and in ways which remained unnoticed by many trade specialists, the United States, the European Union and China tested their beliefs in multilateralism as applied to the trade and investment fields by leading an important negotiation with Iran over the fate of its nuclear programme and its integration in trade and investment regimes (Mallard and Sun 2022). What appeared to be a victory for multilateralism as the Joint Comprehensive Plan of Action (JCPOA) was signed in 2015 soon revealed its weakness when US President Donald Trump walked out of the agreement three years later, sending a shock wave through oil markets and their associated financial sector. As a result of the unilateral reimposition of US sanctions against Iran, and the SWIFT ban imposed against certain Iranian banks, major actors such as China started to think about setting up parallel systems and tools to govern the world economy, such as the CIPS system – an alternative to SWIFT – the Asian Infrastructure Investment Bank (AIIB) and the New Development Bank (NDB). By unilaterally destroying the JCPOA – which is still in the reanimation room as we write – the United States reconfigured the rules of trade and investment in the Middle East, forcing private multinational companies and their banks to choose between following US rules and Chinese rules, with Europe standing in the middle, unable to decide. The other great power driving the weaponisation of economics is indeed China, which has long been scrutinised for its state-controlled exchange rate regime, tight regulation of capital flows, loose intellectual property protection, forced technology transfers and unchecked industrial subsidies. What is worse, the two major global economic powers have been embroiled in a trade war since 2018, following Trump’s attempts to “decouple” the US from Chinese firms like Huawei and restrict investments and technology transfers to China.

Finally, during this last decade, the rise of illiberal leaders – including Trump in the US, the Brexiters in the UK, Putin in Russia, and the list goes on – was accompanied by a new “populist” discourse articulated around the defence of protectionism and the (re)strengthening of national sovereignty, which has further eroded the open foundations of the world economy. A new nationalist era thus seems to be in the making, calling into question the decades-long ascent of powerful multinational corporations challenging (or bypassing) state authority. In what could be described as the “revenge of politics”, the key relation between economics and politics seems to be reverting again in a global trend toward re-nationalising the world economy. In this changing geoeconomic and geostrategic constellation, states are increasingly compelled by populist leaders and a large part of the electorate to fend for themselves, with multilateral mechanisms losing traction and international economic relations gaining in toxicity. Geopolitical combat is increasingly justified in popular discourses, which in turn justifies the actions of leaders who use economic means, such as trade, investment and energy policies, to lure allies, punish adversaries, or coerce those in between. As the “logic of war in the grammar of commerce” (Luttwak 1990) becomes more prevalent, states revert to mercantile toolkits to pursue “war by other means”, including sanctions, controls on trade and capital flows, curbs on technology transfers, fiscal encroachments, and rogue investments.

Covid and the war in Ukraine as aggravating factors

The Covid pandemic and the war in Ukraine have further exacerbated the tensions in the international trading system. In the wake of the pandemic, many governments have resorted to protectionist measures such as export controls and the subsidising of national industries, aiming for self-sufficiency in strategic sectors such as medical supplies or food sovereignty. With its unprecedented string of sanctions, embargoes and retaliations, the war in Ukraine has pushed the logic of economic nationalism and confrontation to new heights. It entails potentially devastating consequences such as rising food and resource prices, the breakdown of global supply chains as well as accelerating inflation globally, all of which may disproportionally hit poor and developing countries.

Though the long-term outcomes and impact of the war in Ukraine are still unknown, four major implications for the world economy can already be identified.

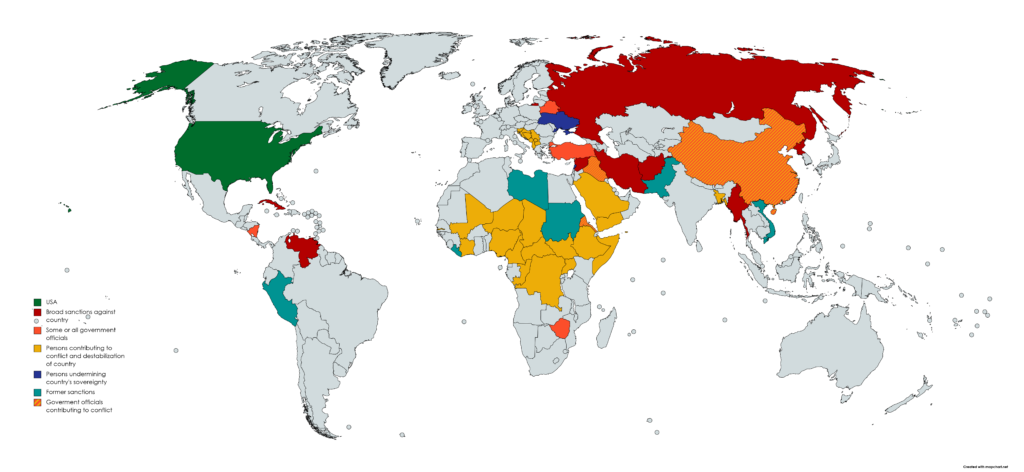

First, the war illustrates how pervasive and customary the global use of sanctions has become over recent decades. The effects of the sanctions against Russia are unprecedented even though the methodology – defined by the range and scope of US-EU sanctions – follows the pattern first experimented with by the US and its allies against Iran in the sanctions built-up that preceded the signature of the JCPOA, from 2012 to 2015. The massive and sudden participation of the private sector proves that multinational companies have understood the lessons of the Iran sanctions and that they do not want to risk reputational costs, preferring to massively “de-risk” by getting out of a country as big as Russia as soon as the war started. Sanctions, however, raise a multitude of questions related to their purpose (deterrence, signalling, attrition, third-party compliance), nature (financial, commercial), design (targeted, smart, secondary, etc.), targets (individuals, companies, states), (in)efficiency, unintended consequences and optimal calibration.

Second, the war in Ukraine is further weakening global value chains as it speeds up the decline in the sourcing of international intermediates, with many nations considering “friendshoring”, “reshoring” or “nearshoring” their production.

Third, the frenetic scramble for dwindling global resources such as oil, gas, timber, minerals and water entails serious risks both for democracies – given most mineral rich countries are autocracies – and for developing countries, which might see themselves further engulfed in neo-imperial relationships of dependency.

Finally, the war in Ukraine may jeopardise the green and digital transitions as necessary components, including minerals and rare earths, may become harder to source and their extraction puts a major strain on local ecosystems.

Towards a new international economic order?

The consequences of these deteriorating international economic relations are manifold and widespread. They raise the question whether a new post-(neo)liberal world order may be emerging, or whether we may merely be facing another episode in capitalism’s constant ebb and flow between more free-trade-oriented and more mercantile periods.

The spiralling logic of deterrence, sanctions and countersanctions, which is likely to continue with the protracted war in Ukraine, casts the ghastly shadow of the 1930s, characterised by an aggressive economic nationalism that eventually triggered a world-wide conflagration. History, indeed, has shown time and again the frailty of interdependence and the dramatic consequences of its breakdown.

Research Office, Geneva Graduate Institute. Globalchallenges.chPODCAST: Are we moving towards a new economic cold war? with Cédric Dupont

Another scenario would consist in the regionalisation or fragmentation of the international economic system. It has long been assumed, indeed, that the formation of regional alliances would contribute to the overall integration of the global economy. Thus the rise of megaregional free trade agreement negotiations like the Regional Comprehensive Economic Partnership (RCEP) or the Transatlantic Trade and Investment Partnership (TTIP) does not, essentially, threaten the existing order but rather reinforce it. The malign version of the fragmentation scenario, however, would involve the formation of more rigid, antagonistic trade blocs. Such a bipolar world could oppose an “authoritarian arc” led by China, and including Russia, to a bloc of “democratic countries” led by the US and the EU. Under such a scenario, remaining neutral would become exceedingly costly, especially for lesser countries, as actors of opposing camps would be mercilessly sanctioned. Many countries, including major powers such as India, Brazil and South Africa, still find themselves on the fence and would be hard pressed to take sides. The formation of hostile camps would also entail increased disciplining and arm-twisting within blocs, a phenomenon that has been described as “weaponized interdependence” (Farrell and Newman 2012). The concept holds that in asymmetrical power relationships and networks, more powerful actors tend to instrumentalise their privileged positions to coerce partners into complying with their norms and preferences. The recent EU initiatives to develop its own set of “unilateral” trade measures – often under the cloak of environmental or sanitary resolutions – in order to be better able to respond to and retaliate against the encroachments of the US, its transatlantic partner, are a case in point.

The future of the international economic system will largely depend on how China is going to position itself, as it now accounts for 29% of world investment and is involved in more than 25% of world trade (Paterson 2022). Accordingly, the potential impact of a further weaponisation of China’s financial and commercial policies is tremendous. While China’s close integration into the world markets would suggest its faithfulness to the extant order, this is called into question by a nationalistic turn internally, an increasingly assertive foreign policy – including in the Global South – and a declared ambition to greater self-reliance.

To conclude, it can be argued that the stakes are high. Given the advanced level of integration and interdependence of today’s global economy, undoing it would come at a very high price. Fragmentation or segregation into blocs would imply higher production and exchange costs for all the actors involved. Some of them, like export- and trade-oriented European and ASEAN countries, would suffer more than others. Outright chaos, or what some have called the “balkanisation” of the world economy (Pomeroy 2022), would prove even worse. As Beatrice Weder di Mauro points out in her video interview (available at the beginning of this article), we may be witnessing the emergence of multiple systems co-existing in a geometric variability of sorts. Unpredictability, however, is something economists and financial investors do not like.

The international economic system thus finds itself at a juncture facing both opportunities for reform and risks of inherent implosion. From a realist perspective, a more mercantile and conflictual international economic system would constitute a return to normality. Only a new hegemon or the establishment of balance of power, to which the formation of blocs could contribute, could stabilise the system. Leftist critics would argue that the current crisis constitutes an opportunity to overhaul a system which they have long denounced as fundamentally flawed and perpetuating neo-imperial structural violence and inequality. Accordingly, they advocate for a “new” new international economic order which would put redistribution and reparations at its centre. For liberals, finally, the rise of economic nationalism and the potential formation of blocs call into question their very conception of an open international order. In the words of Nicholas Mulder, the unabated use of the economic weapon is “stitching animosity into the fabric of international affairs and human exchange” (2021).

[1] Benjamin Constant, The Spirit of Conquest and Usurpation and Their Relation to European Civilization (1814), in Fontana (2010: 43–167, quote 53).

-

Globalisation: The Danger of Safe Spaces

For an extended period in the second half of the 20th century, Thomas Friedman’s “Golden Arches” theory – the proposition that no two countries with a McDonald’s had ever fought each other – remained largely unchallenged. Not only has the Russian war in Ukraine consigned this metaphor of conflict prevention to history, contends Rui Esteves, postwar multilateralism itself is now increasingly under threat from economic protectionism and geopolitical rivalries.

-

Risky Interdependence: The Impact of Geoeconomics on Trade Policy

Although Covid-19 and the Russian war in Ukraine will most likely represent only transient threats to the world economy, they happen to coincide with a number of structural threats to the global economic outlook. Joost Pauwelyn surveys these threats and explores a broad range of possible responses, from unilateral instruments, such as sanctions or export controls, to multilateral cooperation agreements.

-

A New Page in Global Sanctions Practice: The Russian Case

Approximately one third of the world’s population currently lives under an economic sanctions regime. Situating the current sanctions against Russia within this broader context, Erica Moret contends that these sanctions are unique not only because they target a major G20 economy, but also because – unusually – the object of sanctions is itself in a position to react in potentially devastating ways against the countries imposing the sanctions.

-

The Politicisation of the Commodities Trade

In the aftermath of the war in Ukraine, countries around the world are keen to reduce their dependence on a single – potentially hostile – country for key commodity imports. As a result, writes Giacomo Luciani, the commodities trade is becoming increasingly politicised, and an unremitting focus on finding the lowest cost supplier is giving way to other more pressing geopolitical concerns.

-

Sanctions against Russia and the Role of the United Nations

If the current sanctions against Russia are not unprecedented – both Iran and North Korea have been subject to sanctions that are more extensive – they are the first to target so extensively a country so closely integrated in the world economy. Despite their breadth, however, these sanctions should not be understood as economic warfare, argues Thomas Biersteker, but as a set of restrictive measures aimed at achieving a specific policy goal.

-

A Renewed Neocolonial Scramble for Resources?

For centuries, industrial economies have competed for resources from commodity-rich countries in the Global South. In the 21st century, argue Gilles Carbonnier and Rahul Mehrotra, a scramble for commodities is again underway, as developed countries compete to secure access to agricultural and mineral resources alike. Once again, however, the citizens of the Global South are not fully benefitting from the export of their natural wealth.

-

The Rise of Geoeconomics

In the post-Cold War world, economic instruments – from national investment policies to trade sanctions – have taken on growing importance as instruments of foreign policy. Zakaria Imessaoudene examines this trend through the lens of the term “geoeconomics”, charting the factors behind this relatively recent development. He investigates the challenges posed by geoeconomics for the multilateral international order, in particular in view of China’s rise as a geoeconomic powerhouse.

-

Debt as a Political Weapon?

During the “lost decade” of the 1980s, a number of low- and middle-income countries were engulfed in a large-scale debt crisis, leading to stagnating or declining living standards. Against a similar backdrop of rampant inflation and rising interest rates, Carlo Edoardo Altamura investigates whether some countries in the Global South might face a similar fate today.

-

Global Sanctions: A Bibliography from the Graduate Institute

A quick look at the Graduate Institute’s academic production dealing with sanctions issues. For more details, please visit the library.

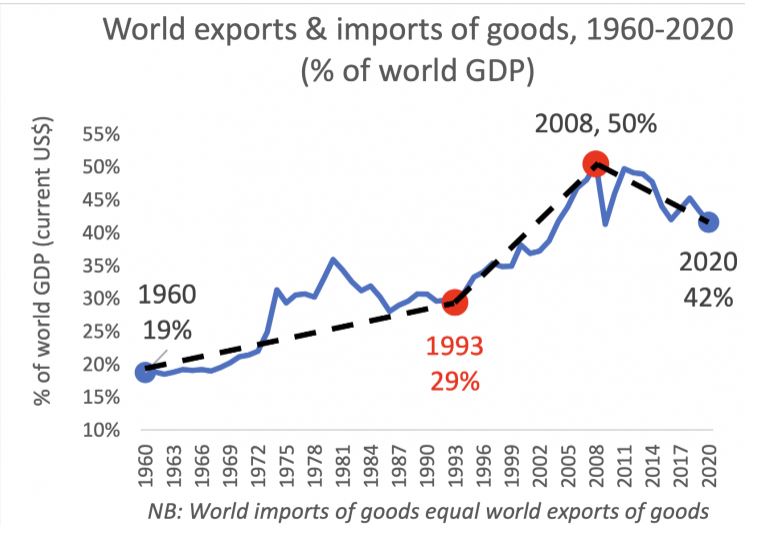

GRAPH: The “globalisation has peaked” lazy narrative

Richard Baldwin’s calculations based on WTO (trade data) and WDI database (GDP data, current USDs) / VoxEU.org. For the author, the ‘globalisation has peaked’ narrative is overly simplistic. Of the four largest traders in the world, one peaked well before 2008, while two peaked well after. The world’s largest trader – the EU – did not peak, even if its trade-to-GDP ratio has not risen for a decade.

VIDEO: Why integrated trade networks matter, with Richard Baldwin

VOXeu and CEPR (Geneva Graduate Institute)

PODCAST: Economic nationalism in the light of the long-term history of capitalism, with Gopalan Balachandran

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: Overview of the WTO challenges in 2022, with Manuel Miranda

Research Office, Geneva Graduate Institute, 2022. Globalchallenges.org

PODCAST: China and the changing global economic landscape, with Sung Min Rho

Research Office, Geneva Graduate Institute. Globalchallenges.ch

PODCAST: The Economic Weapon in Global Governance, with Nicholas Mulder

Geneva Graduate Institute

DEFINITIONS related to sanctions and economic warfare

Research Office, Geneva Graduated Institute. Questions largely inspired by the Council on Foreign Relations, www.cfr.org.